We all want to get our feet into the vast waters of investing. For some with the capital it is as easy as setting up and getting going. For others, however, it can seem a little more complicated and intimidating. From stocks, binary options to CFDs the options of how to invest your money are many.

This article is focused on one of the many options and methods of investing. I will go over CFD:s, what they are, how you can use them as an investment tool and more. We hope to answer your questions about CFDs in one article, while making sure you have the basic knowledge of how to make money with CFD trading.

What is a C F D?

When we say basics, we mean basics. So, let’s begin there, basically, CFDs or Contracts for Differences, are arraignments between two parties (usually a buyer and a broker). The CFD agreements are setup so that a buyer purchases the gains and losses of a stock or asset for a predetermined time. The actual stocks ownership does not change hands, but the movements of the value of the stock do.

When we say basics, we mean basics. So, let’s begin there, basically, CFDs or Contracts for Differences, are arraignments between two parties (usually a buyer and a broker). The CFD agreements are setup so that a buyer purchases the gains and losses of a stock or asset for a predetermined time. The actual stocks ownership does not change hands, but the movements of the value of the stock do.

This can seem confusing to some, so we can dive a little deeper. A CFD is a contract traded between a client and a broker where the parties exchange the value difference in the asset between the beginning and end of a contract. This allows you to trade on stocks you don’t owe and might otherwise not be able to purchase.

Like I mentioned above, CFDs give the investors without massive starting capitals the join in the fun and excitement of trading. The traditional way of purchasing your own assets and profiting from their movements is still arguably the best way forward. But these purchases also come with high price tags. So, why not reduce your risk greatly and instead invest in a CFD. Not only do you reduce the starting investment made, you also get to take advantage of other benefits, like trading on a margin.

You read that right, as if investing in CFDs wasn’t already good enough, these contracts are also a leveraged product.

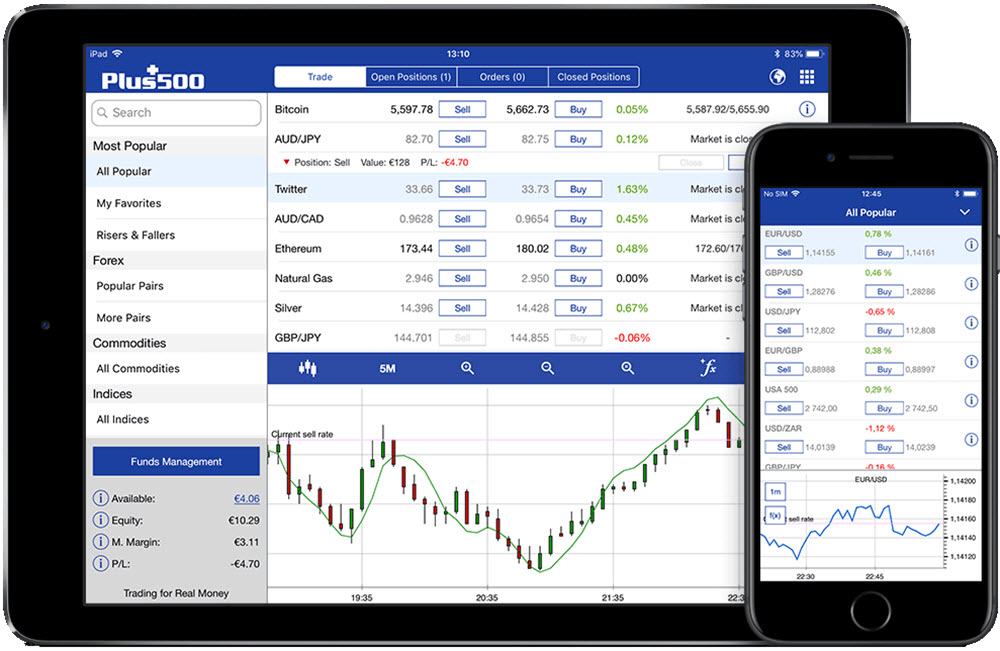

To trade CFDs you need an account with a CFD broker such as Plus500, Avatrade, eTore, or XM.

Leveraging your CFDs

One of the most intriguing aspects of Contracts for Differences is it being a leveraged product. Leveraged products are both risky and rewarding at the same time. With these types of products, you only need to invest a small part of the total value of the product to open a position. This is called ‘trading on a margin’. When trading on a margin, you might need anywhere from .5-20% of the total value of the asset to buy a position.

This part can seem complicated to most, so let’s use a small example to explain how this works on paper. For this example, we will pretend you are interested in purchasing 100 shares of an asset that is trading at $25 a share. Normally you would need to deposit $25/share or $2,500. With CFDs however, you will only need to cover the margin deposit which is set at 1%. So, what should cost you $2,500 now only costs you 1% of that or $25. So, you can purchase a position of 100 shares of an asset for the same price as purchasing one of the same assets straight up.

Leverage is great… But, How Do I Make Money?

Small investments usually mean small returns. This is why most CFDs are for hundreds or thousands of shares. I want to break down the calculations you will need to know to figure out your winnings or losses with CFDs.

Imagine you purchased 100 shares of an asset at $50/share for a total of $5,000. with a trading margin of 10%, you only have to deposit $50 to purchase the rights to those 100 shares from beginning of contract to end. During the time period of the contract if the share price of the asset rises from $50/share to $55/share. Your gross profit from this 5-pip change would be $500, with a commission of $50 to close out. Winning $500 on a $50 investment is magical. No?

To most this sounds like a dream, and this is where we have to wake you up. As great as leveraged products and trading on a margin is, it is a double-edged sword. We all want to take 50 and turn it into a 500, but remember trading on a margin is as risky as it is rewarding. Losing $500, when you only had $50 to invest is a very real fear of trading on margins. If the asset takes a nose dive or drops enough you could be looking at owing more than you ever planned to invest. Always keep this in mind, trading on a margin is as much your friend as your enemy.

Lowering Risk-Raising Knowledge

As with any form of investment, the best way to protect yourself against major losses and mistakes that all investors make, is to educate yourself. Intelligent investments are the ones that turn into the best results. If you do your due diligence and stay up to date on your information and trends, you can turn investing and trading on a margin to weapons in your economic arsenal.

Never take positions in CFDs or any other methods of investing without familiarizing yourself with the assets and markets you are interested in. Following days, months, and years of trends and flows of the market can make a world of difference in predicting the way the assets value will move. When you can use identifiers and trends to your advantage then CFDs with their short-term contracts become a playground of availability.

Thanks to the Contracts for Differences, you no longer need to be a big boy to trade with them. CFDs allow all swimmers to give the deep end a try before culminating enough capital to take a permanent position in the market. Utilize CFDs regardless of your budget to strengthen your economic profile, stance, and portfolio.

I hope this article was able to answer all your questions about the basics of CFDs. Use the information provided here and across the web to help you make the right investing decisions for you.